UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_____________________________________

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

_____________________________________

|

| | | |

| | Filed by the Registrant x | Filed by a Party other than the Registrant o |

| | Check the appropriate box: | |

| | | | |

xo | | Preliminary Proxy Statement |

| | | |

| o | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| | | |

ox | | Definitive Proxy Statement |

| | | |

| o | | Definitive Additional Materials |

| | | |

| o | | Soliciting Material Pursuant to §240.14a-12 |

ENSTAR GROUP LIMITED

(Name of Registrant as Specified inIn Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

|

| | | | |

| | Payment of Filing Fee (Check the appropriate box): |

| x | | No fee required. |

| | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | | (1) | | Title of each class of securities to which transaction applies: |

| | | (2) | | Aggregate number of securities to which transaction applies: |

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | | (4) | | Proposed maximum aggregate value of transaction:transaction |

| | | (5) | | Total fee paid: |

| | | | | |

| o | | Fee paid previously with preliminary materials. |

| o | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | | | | |

| | | (1) | | Amount Previously Paid: |

| | | (2) | | Form, Schedule or Registration Statement No.: |

| | | (3) | | Filing Party: |

| | | (4) | | Date Filed: |

Dear Fellow Shareholder:Shareholders:

On behalf of Enstar Group Limited's Board of Directors, I invite you to join us at a Specialonline for our 2020 Annual General Meeting of Shareholders on , November , 2019Thursday, June 11, 2020 at 9:00 a.m. Atlantic time, whichtime. Due to public health and travel concerns related to the coronavirus (COVID-19) pandemic, this year’s Annual General Meeting will be held at our headquarters, Windsor Place, 3rd Floor, 22 Queen Street,solely by means of a virtual meeting over live webcast. The matters we will vote on are described in Hamilton, Bermuda.

The Special Meeting has been called to approve an amendment and restatementthe notice of the Annual General Meeting and the Proxy Statement that follow. I also encourage you to read our 2019 Annual Report on Form 10-K.

Enstar Group Limited 2016 Equity Incentive Plan. The proposed amendments would allowremains a leader in the run-off space and our business is fundamentally strong. Through innovation, discipline, financial optimization and operational excellence, we are delivering market-leading insurance solutions and providing long-term value for shareholders.

Enstar has grown significantly in asset size, with over $14.7 billion of cash and investments at year-end, up from $12.5 billion in the prior year. Increasingly, our invested assets drive a substantial amount of our earnings, as evident from our 2019 financial results. Our net earnings were $902.2 million for the year, or $41.43 per fully diluted ordinary share, the highest in our history by far, primarily driven by realized and unrealized gains on investments. This was in sharp contrast to consolidated net losses in 2018 of $162.4 million, a loss of $7.84 per fully diluted share, highlighting the impact of market volatility on our investment portfolios.

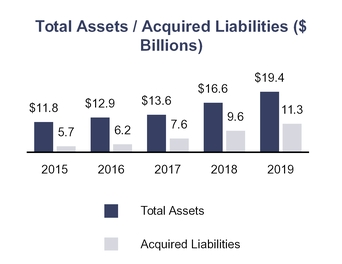

In our core Non-life Run-off segment, our claims teams again expertly managed our $11.3 billion of loss reserves and defendant asbestos and environmental liabilities. Claims management continues to be our "front office," a characteristic that is unique to Enstar.

Our strength in managing claims allows us to continue to acquire new business, and at the Board level we spend considerable time overseeing the execution of our acquisition strategy. In addition to reinsurance-to-close and more traditional reinsurance solutions, we remained active in the corporate space, acquiring Morse TEC in October 2019, which built upon the initial success of our acquisition of Dana Companies in 2016 and other recent transactions. These corporate legacy solutions expand our client base and offer greater investment flexibility than a traditional (re)insurance deal.

With Enstar's growth comes a Board responsibility to oversee our operational platform and technological resources, as well as the related risks. Through our annual Board evaluation process, we identified the need to build greater expertise in these areas. Following an extensive search process, we were pleased to have Myron Hendry, formerly the Chief Platform Officer of XL Catlin, join our Board as an independent director in July.

We did not make equity awards throughany significant changes to our compensation programs for 2019, and compensation reported for the use of a Joint Share Ownership Plan, or JSOP, structure. In connection with implementing the JSOP structure, we are also seeking authorization of an additional 650,000 ordinary shares for use under the Amended and Restated Plan. The additionyear reflected maximum achievement of the JSOPcorporate financial component of our annual incentive award program due to our strong 2019 results. Executive bonuses therefore increased relative to 2018, when we did not meet the Amendedthreshold levels of corporate financial performance. During the year, the Compensation Committee focused on securing and Restated Plan will enableincentivizing our leadership team, and in January 2020, we announced new employment agreements and long-term incentive awards with our Chief Executive Officer, President and Chief Operating Officer for terms continuing into 2023.

Compensation Committee Chairman Rick Becker and I engaged with our shareholders and proxy advisory firms for the fifth consecutive year, an exercise which has continued to provide us with valuable insight. For the benefit of those who have not been involved in our shareholder engagement meetings, the Proxy Statement includes a summary of the primary issues we covered. We encourage shareholders interested in speaking with us to provide long-term equity incentive awards that are tax-efficient for U.K. tax residents. For more information, see "The Proposal" section in the accompanying proxy statement.participate next year.

Your support is important, so pleaseI urge you to vote as soon as possible using the internet, telephone, or, if you received a proxy/voting instruction card, by completing,marking, dating, and signing it, and returning it by mail. All of our directors look forward to better times when we can safely convene in person. In the enclosed proxy card inmeantime, I hope you join us online for the enclosed postage prepaid envelope. You may also vote using the Internet or telephone by following the instructions on the enclosed proxy card.2020 Annual General Meeting.

Thank you for your continued support.

|

|

| Sincerely, |

|

| Robert J. Campbell |

| Chairman of the Board |

ENSTAR GROUP LIMITED

NOTICE OF SPECIAL2020 ANNUAL GENERAL MEETING OF SHAREHOLDERS

November , 2019June 11, 2020

To the shareholders of Enstar Group Limited:

Notice is hereby given that a Specialthe 2020 Annual General Meeting of Shareholders (the "Special Meeting") of Enstar Group Limited (the "Company" or "Enstar") will be held at the following timelocation and location for the following purpose:purposes:

|

| | |

| When: | , November , 2019Thursday, June 11, 2020 at 9:00 a.m. Atlantic time (8:00 a.m. Eastern time) |

| Where: | Windsor Place, 3rd Floor

22 Queen Street

Hamilton, Bermuda HM11The Annual General Meeting can be accessed virtually via the Internet by visiting www.virtualshareholdermeeting.com/ESGR2020.

|

ItemItems of Business: | 1. | To elect four Class II Directors nominated by our Board of Directors to hold office until 2023. |

| 2. | To hold an advisory vote to approve an amendmentexecutive compensation. |

| 3. | To ratify the appointment of KPMG Audit Limited as our independent registered public accounting firm for 2020 and restatementto authorize the Board of Directors, acting through the Enstar Group Limited 2016 Equity Incentive Plan.Audit Committee, to approve the fees for the independent registered public accounting firm. |

| Who Can Vote: | Only holders of record of our voting ordinary shares at the close of business on October , 2019April 15, 2020 are entitled to notice of and to vote at the meeting. |

You are cordially invited to attend the Specialvirtual Annual General Meeting. Due to public health and travel concerns related to the COVID-19 pandemic, this year’s Annual General Meeting will be held solely by means of a virtual-only meeting over live webcast. So long as you were a holder of record of our voting ordinary shares as of the close of business on April 15, 2020, you or your proxyholder can attend the meeting, submit your questions, and vote your shares electronically at the virtual Annual General Meeting by visiting www.virtualshareholdermeeting.com/ESGR2020 and using your control number included in person. the proxy materials. During the meeting, you will be able to ask questions and will have the opportunity to vote to the same extent as you would at an in-person meeting of shareholders.

To ensure that your vote is counted at the meeting, however, please vote as promptly as possible. Submitting your proxy now will not prevent you from voting your shares at the meeting if you desire to do so, as your vote by proxy is revocable at your option in the manner described in the accompanying proxy statement.

|

|

| By Order of the Board of Directors, |

|

| Audrey B. Taranto |

| General Counsel and Corporate Secretary |

| Hamilton, Bermuda |

October ,April 28, 2020 |

|

|

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL GENERAL MEETING OF SHAREHOLDERS TO BE HELD ON JUNE 11, 2020 This notice of meeting, the proxy statement, the proxy card and the annual report to shareholders for the year ended December 31, 2019 are available at https://investor.enstargroup.com/annual-reports. |

TABLE OF CONTENTS

PROXY STATEMENT SUMMARY

To assist you in reviewing our proxy statement, we have summarized several key topics below. The following description is only a summary and does not contain all of the information that you should consider before voting. For more complete information, you should carefully review the rest of our proxy statement, as well as our Annual Report to Shareholders for the year ended December 31, 2019.

Annual General Meeting of Shareholders Information |

| |

Date and Time

| Place |

| June 11, 2020 | The Annual General Meeting can be accessed virtually via the Internet by visiting: www.virtualshareholdermeeting.com/ESGR2020 |

| 9:00 a.m., Atlantic time |

| Record Date | Voting |

| April 15, 2020 | Your vote is very important and we urge you to vote as soon as possible. See Question and Answer No. 10 on Page 2 for voting instructions |

|

|

| | |

| Proposal | Board of Directors’ Vote Recommendation | Page References |

1. Election of Directors: B. Frederick Becker James Carey W. Myron Hendry, Jr. Hitesh Patel

| FOR the Director Nominees | Page 6 (Nominee Biographies) |

| 2. Advisory Approval of Enstar’s Executive Compensation | FOR | Page 32 (Compensation Discussion and Analysis) Page 47 (Summary Compensation Table) |

| 3. Ratification of KPMG Audit Limited as the Independent Registered Public Accounting Firm for 2020 | FOR | Page 60 (Audit and Non-Audit Fees Table) |

Board Composition

The following describes our current Board composition and current committee assignments of each of our directors.

|

| | | | | | |

| Director | Director Since | Age | Primary Occupation | Independent | Board Committee Membership* | Other Current Public Boards |

Robert Campbell (Chairman) | 2007 | 71 | Partner, Beck Mack and Oliver | þ | AC, CC, NGC, IC, EC | 1 |

| Dominic Silvester | 2001 | 59 | CEO, Enstar Group Limited | | EC | 0 |

| B. Frederick Becker | 2015 | 73 | Chairman, Dorada Holdings Ltd. (Bermuda) | þ | AC, CC, NGC | 0 |

| James Carey | 2013 | 53 | Senior Principal, Stone Point Capital | | IC | 1 |

| Hans-Peter Gerhardt | 2015 | 64 | Former CEO of Asia Capital Re, PARIS RE and AXA Re | þ | RC | 0 |

| W. Myron Hendry | 2019 | 71 | Former Executive Vice President and Chief Platform Officer, XL Catlin | þ | NGC, RC | 0 |

| Jie Liu | 2017 | 41 | Partner, Hillhouse Capital | | IC | 0 |

| Paul O’Shea | 2001 | 62 | President, Enstar Group Limited | | | 0 |

| Hitesh Patel | 2015 | 59 | Former CEO, Lucida plc; former KPMG Partner | þ | AC, NGC, RC | 0 |

| Poul Winslow | 2015 | 54 | Managing Director, CPPIB | þ | CC, IC, EC | 0 |

*Committee Legend: AC - Audit CC - Compensation NGC - Nominating and Governance RC - Risk IC - Investment EC - Executive |

|

| | |

| Enstar Group Limited | i | 2020 Proxy Statement |

Board Statistics

|

| | | | | |

| ● | Added 1 new director in 2019 (Myron Hendry) | ● | Global Perspective: 6:4 ratio of Internationally Residing vs. US Directors |

| ● | Average Board Tenure: | 8 years | ● | Average Board Age: | 61 |

| ● | Median Board Tenure: | 5 years | ● | Median Board Age: | 61 |

Enstar is committed to sound governance, and we employ a number of practices that the Board believes are in the best interests of the Company and our shareholders. Highlights of these practices are listed below.

|

| | | |

| ● | An independent director serves as Chairman of the Board | ● | No "over-boarding" - none of our current directors serve on the Board of more than one other publicly traded company |

| ● | Board Diversity Policy | ● | Shareholder engagement program to solicit feedback on governance and compensation programs |

| ● | Robust Share Ownership Guidelines for executives and non-employee directors | ● | Shareholder advisory vote on executive compensation held annually |

| ● | Majority voting standard in uncontested elections of directors | ● | Compensation Committee engages an independent compensation consultant |

| ● | No super-majority voting requirements other than as required by Bermuda law | ● | Clawback Policy |

| ● | No shareholder rights plan ("poison pill") | ● | Robust code of conduct that requires all employees and directors to adhere to high ethical standards |

| ● | Annual risk assessment of compensation programs | ● | Regular executive sessions of independent directors |

| ● | Annual Board and Committee performance evaluations | ● | Anti-hedging policy (applicable to directors and all employees) |

| ● | Majority of independent directors, entirely independent Audit, Compensation, and Nominating and Governance Committees | ● | Equity incentive plan prohibits re-pricing of underwater stock options and stock appreciation rights |

|

| | |

| Enstar Group Limited | ii | 2020 Proxy Statement |

Business Highlights

Enstar is a multi-faceted insurance group that offers innovative capital release solutions and specialty underwriting capabilities through its network of group companies in Bermuda, the United States, the United Kingdom, Continental Europe, Australia, and other international locations. Select highlights of 2019 included:

|

| |

Significantgrowth throughacquisitions: |

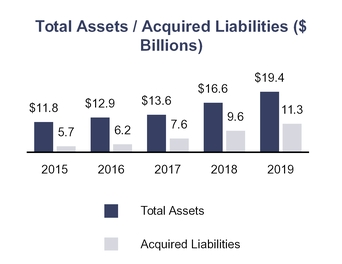

| ● | Total assets increased by 17.0% from $16.6 billion in 2018 to $19.4 billion in 2019. |

| ● | We acquired $2.8 billion of gross loss reserves during 2019 through the completion of new run-off transactions. |

| ● | Losses and loss adjustment expenses and other asbestos and environmental liabilities increased by 17.3% during 2019 due to significant acquisition activity during the year. |

| |

|

| |

| Significant increase in book value per share: |

| ● | Fully diluted book value per share was $197.93 as of the end of 2019, compared to $155.94 at the end of 2018. |

| ● | Since initiating our public listing process in 2006, our fully diluted book value per share has increased at a 15.1% compound annual growth rate. |

| |

|

| |

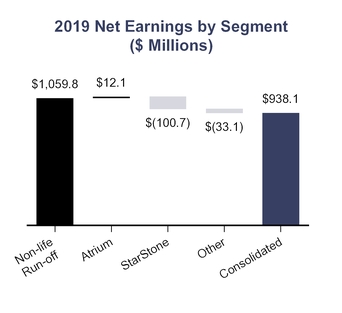

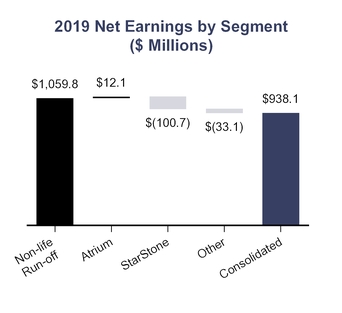

| Posted record net earnings of $938.1 million: |

| ● | Net earnings of $938.1 million for the year were primarily the result of realized and unrealized gains on our investments, partially offset by losses in our StarStone segment. |

| ● | Reduction in prior period estimates of net ultimate losses in the Non-life Run-off segment of $220.0 million. |

| ● | StarStone losses driven primarily by losses from exited lines of business, reserve strengthening in U.S. casualty, and prior year adverse development, as we worked to reposition and remediate the business. |

| |

|

| | |

| Enstar Group Limited | iii | 2020 Proxy Statement |

Executive Compensation

Philosophy:

We are a rapidly growing company operating in an extremely competitive and changing industry. Our compensation program is based on these core principles:

|

|

| Incentivize performance consistent with clearly defined corporate objectives |

| Align our executives’ long-term interests with those of our shareholders |

| Fairly compensate our executives |

| Retain and attract qualified executives who are able to contribute to our long-term success |

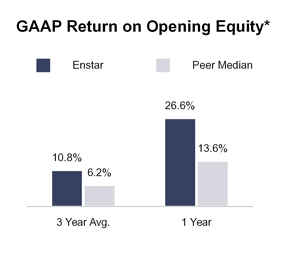

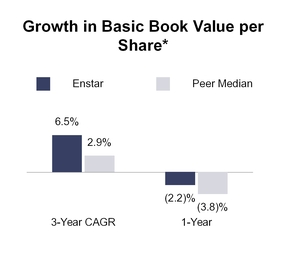

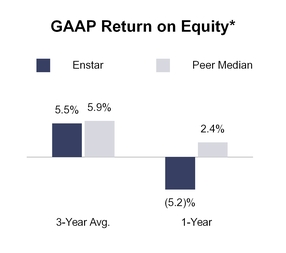

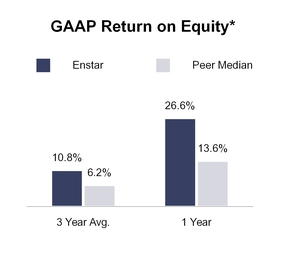

2019 Performance Versus Peers:

| |

| * | Source: S&P Market Intelligence for peer company data. Peer group includes the companies selected as our peers by our Compensation Committee, as described in "Compensation Discussion and Analysis - Peer Group." |

Key Compensation Decisions for 2019 Performance Year:

Our Compensation Committee made the key compensation decisions listed below.

CEO / President / COO Long-term Incentives - No new long-term equity incentive awards were granted in 2019 to these executive officers following grants made to them in 2017 that covered a three-year period. New long-term equity incentive awards were made in January 2020 intended to cover new three-year periods.

Annual Incentive Awards - Maximum levels of Company financial performance measures were achieved in our annual incentive program, which led to full realization of the financial performance portion of the executive officers' award potential. Achievement of individual performance objectives were assessed at levels ranging from "threshold" to "exceeds."

Other Long-term Incentives - The CFO and CIO received long-term equity incentive awards as part of annual award consideration, consisting of 65% performance share units ("PSUs") and 35% restricted share units ("RSUs"). The CIO received an RSU retention award that cliff vests on the third anniversary of grant date.

|

| | |

| Enstar Group Limited | iv | 2020 Proxy Statement |

Shareholder Engagement:

|

|

Results of 2019 Say-on-Pay: At last year's annual general meeting held on June 11, 2019, our shareholders approved the compensation of our executive officers with 85% of the total votes cast in favor of the proposal. This was a slight decrease from 2018. Our Board of Directors primarily attributes the decrease to our 2018 financial performance and certain features of our compensation program that reflect Enstar's unique business and structure. |

Engagement with Large Shareholders: In 2019, we sought feedback from our large shareholders and proxy advisory firms, speaking to the holders of approximately 19% of our outstanding voting shares, as described on page 43. We also spoke to two major proxy advisory firms, and invited conversations with several additional significant shareholders who advised that they did not feel a need to meet with us this year. Directors whose firms represent an additional 23% of our outstanding voting ordinary shares are actively involved in our Board's oversight of compensation and governance matters, and were not included in the engagement program. |

Cautionary Statement Regarding Forward-Looking Statements

This proxy statement contains certain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934 with respect to our compensation policiesfinancial condition, results of operations, business strategies, operating efficiencies, competitive positions, growth opportunities, plans and practices.objectives of our management, as well as the markets for our securities and the insurance and reinsurance sectors in general. Statements that include words such as "estimate", "project", "plan", "intend", "expect", "anticipate", "believe", "would", "should", "could", "seek","estimate," "project," "plan," "intend," "expect," "anticipate," "believe," "would," "should," "could," "seek," "may" and similar statements of a future or forward-looking nature identify forward-looking statements for purposes of the federal securities laws or otherwise. Forward-lookingForward- looking statements may appear throughout this proxy statement, including in the Chairman's letter and Annual Incentive Plan section under the caption "Compensationof Compensation Discussion and Analysis".& Analysis.

These statements include statements regarding the intent, belief or current expectations of the CompanyEnstar and its management team. Investors are cautioned that any such forward-looking statements speak only as of the date they are made, are not guarantees of future performance and involve risks and uncertainties, and that actual results may differ materially from those projected in the forward-looking statements as a result of various factors. In particular, the evolving COVID-19 pandemic has caused significant economic and financial turmoil globally, as well as uncertainty in the financial markets, which has caused declines in the market value of our invested assets. Due to the global uncertainty, we are unable to predict the longer-term effects of the pandemic on our business at this time. Additional important risk factors regarding the CompanyEnstar can be found under the heading "Risk Factors" in our Annual Report on Form 10-K for the year ended December 31, 2018.2019. Furthermore, the CompanyEnstar undertakes no obligation to update any written or oral forward-looking statements or publicly announce any updates or revisions to any of the forward-looking statements contained herein, to reflect any change in its expectations with regard thereto or any change in events, conditions, circumstances or assumptions underlying such statements, except as required by law.

This proxy statement speaks as of the date of mailing. However, the discussion about our financial, operational and strategic performance relating to fiscal year 2019 has not been edited to provide any update with respect to COVID-19 or our 2020 results of operations or financial performance.

|

| | |

| Enstar Group Limited | v | 2020 Proxy Statement |

ENSTAR GROUP LIMITED

Windsor Place, 3rd Floor

22 Queen Street

Hamilton, Bermuda

PROXY STATEMENT

SPECIAL2020 ANNUAL GENERAL MEETING OF SHAREHOLDERS

QUESTIONS AND ANSWERS

|

| |

| 1. | Why am I receiving these proxy materials? |

We have made these proxy materials available to you on the internet or, in some cases, have delivered printed copies of these proxy materials to you by mail in connection with the solicitation of proxies by the Board of Directors (the "Board") of Enstar Group Limited (the "Company" or "Enstar") for use at a Specialthe 2020 Annual General Meeting of Shareholders (the "Special Meeting") of the Company to be held on November , 2019Thursday, June 11, 2020 at 9:00 a.m. Atlantic time attime. Due to concerns regarding COVID-19, this year’s Annual General Meeting will be held via the internet and will be a completely virtual meeting hosted by members of our Company headquarters, Windsor Place, 3rd Floor, 22 Queen Street, Hamilton, Bermuda, and at any postponement or adjournment thereof.management team in Bermuda. These proxy materials are first being sent or given to shareholders on October , 2019.April 28, 2020. You are invited to attend the Specialvirtual Annual General Meeting and are requested to vote on the amendment and restatement of the Enstar Group Limited 2016 Equity Incentive Plan (the "Amended and Restated Plan") asproposals described in this proxy statement (the "Proxy Statement").statement.

|

| |

| 2. | Why did I receive a one-page notice in the mail regarding the internet availability of proxy materials instead of a full set of proxy materials? |

Pursuant to rules adopted by the Securities and Exchange Commission (the "SEC"), we have elected to provide access to our proxy materials via the internet. Accordingly, we are sending a Notice of Internet Availability of Proxy Materials (the "Notice") to our shareholders. All shareholders will have the ability to access the proxy materials on the website referred to in the Notice or request to receive a printed set of the proxy materials. Instructions on how to access the proxy materials over the internet or to request a printed copy are included in the Notice. In addition, shareholders may request proxy materials in printed form by mail or electronically by email on an ongoing basis.

We believe that providing access to our proxy materials via the internet will expedite shareholders’ receipt of materials, while lowering costs and reducing the environmental impact of our Annual General Meeting because we will print and mail fewer full sets of materials.

|

| |

| 3. | What is included in these proxy materials? |

These "proxy materials" include this proxy statement, our Annual Report to Shareholders for the noticeyear ended December 31, 2019 and, if you received printed copies of Special Meeting (the "Notice"), this Proxy Statement and the accompanyingproxy materials by mail, the proxy card. We have included the Annual Report for informational purposes and not as a means of soliciting your proxy.

|

| |

3.4. | What matters are being voted on at the SpecialAnnual General Meeting? |

Shareholders will vote on the following proposals at the SpecialAnnual General Meeting:

| |

| 1. | To approve an amendment and restatementelect four Class II Directors nominated by our Board of the Enstar Group Limited 2016 Equity Incentive Plan. Directors to hold office until 2023. |

| |

| 2. | To hold an advisory vote to approve executive compensation. |

| |

| 3. | To ratify the appointment of KPMG Audit Limited ("KPMG") as our independent registered public accounting firm for 2020 and to authorize the Board of Directors, acting through the Audit Committee, to approve the fees for the independent registered public accounting firm. |

| |

| 4. | To transact such other business as may properly come before the meeting and any postponement or adjournment thereof. |

|

| |

4. | Why is the Company seeking shareholder approval of the Amended and Restated Plan? |

The Amended and Restated Plan (as described below under "The Proposal - Approval of the Amended and Restated Enstar Group Limited 2016 Equity Incentive Plan") will enable the Company to provide long-term equity incentive awards that are tax-efficient for U.K. tax residents. The proposed amendments would allow us to make equity awards through the use of a Joint Share Ownership Plan ("JSOP") structure. In connection with implementing the JSOP structure, we are also seeking authorization of an additional 650,000 ordinary shares for use under the Amended and Restated Plan.The Amended and Restated Plan will be an amendment and restatement of the existing 2016 Equity Incentive Plan, and therefore shareholder approval is required. In order to implement the Amended and Restated Plan in 2019, the Company has called the Special Meeting as described in the Notice included in this Proxy Statement.

|

| |

| 5. | What isare the Board’s voting recommendation?recommendations? |

The Board recommends that you vote your shares "FOR" approval of the amendment and restatement of the Company's 2016 Equity Incentive Plan.shares:

|

| |

6.1. | What happens if shareholders do not approve"FOR" the Amended and Restated Plan?nominees to serve on our Board (Proposal No. 1). |

If shareholders do not approve the Amended and Restated Plan, our existing 2016 Equity Incentive Plan will continue to remain in full force and effect without modification, and we would not be able to offer JSOP awards to key executives who are U.K. tax residents. This would limit our flexibility to make tax-efficient awards that would help us retain and incentivize key executives. Failure of our shareholders to approve the Amended and Restated Plan also would not affect the rights of existing award holders under our existing 2016 Equity Incentive Plan or under any previously granted awards under that plan.

|

| | |

| Enstar Group Limited | 1 | Special Meeting2020 Proxy Statement |

| |

| 2. | "FOR" advisory approval of the resolution on our executive compensation (Proposal No. 2). |

| |

| 3. | "FOR" the ratification of the appointment of KPMG as our independent registered public accounting firm for 2020 and the authorization of our Board, acting through the Audit Committee, to approve the fees for the independent registered public accounting firm (Proposal No. 3). |

|

| |

7.6. | AreHow can I get electronic access to the proxy materials also available electronically?materials? |

The Notice includes instructions regarding how to:

| |

| 1. | View on the internet our proxy materials for the Annual General Meeting; and |

| |

| 2. | Instruct us to send future proxy materials to you by email. |

Our proxy materials are also available on our website under "Annual General Meeting Materials" at https://investor.enstargroup.com/annual-reports.

|

|

Choosing to receive future proxy materials by email will save us the cost of printing and mailing documents to you. If you choose to receive future proxy materials by email, you will receive an email message next year with instructions containing a link to those materials and a link to the proxy voting website. Your election to receive proxy materials by email will remain in effect until you terminate it. |

|

| |

8.7. | Who may vote at the SpecialAnnual General Meeting? |

Only holders of record of our voting ordinary shares as of the close of business on October , 2019April 15, 2020 (the "Record Date""record date") are entitled to notice of and to attend and vote at the SpecialAnnual General Meeting. Holders of our non-voting convertible common shares are welcome to attend the Special Meeting but may not vote these shares at the meeting or any postponement or adjournment thereof. As used in this Proxy Statement,proxy statement, the term "ordinary shares" does not include our non-voting convertible common shares. As of the Record Date,record date, there were 18,620,876 ordinary shares issued and outstanding and entitled to vote at the SpecialAnnual General Meeting, which number includes 9,483 unvested restricted shares. EachExcept as set forth in our bye-laws, each ordinary share entitles the holder thereof to one vote.

|

| |

9.8. | What is the difference between a shareholder of record and a beneficial owner of shares held in street name? |

Shareholder of Record. If your shares are represented by certificates or book entries in your name so that you appear as a shareholder on the records of American Stock Transfer & Trust Company, our stock transfer agent, you are considered the shareholder of record with respect to those shares, and the Notice or, in some cases, the proxy materials, were sent directly to you. If you request printed copies of the proxy materials, you will also receive a proxy card.

Beneficial Owner of Shares Held in Street Name. If your shares are held in an account at a brokerage firm, bank, broker-dealer or other similar institution, then you are the beneficial owner of shares held in street name and the proxy materials wereNotice was forwarded to you by that institution. The institution holding your account is considered the shareholder of record for purposes of voting at the SpecialAnnual General Meeting. As a beneficial owner, you have the right to instruct that institution on how to vote the shares held in your account.

|

| |

10.9. | What do I do if I received more than one set ofNotice or proxy materials?card? |

If you receive more than one set ofNotice or proxy materialscard because you have multiple accounts, you should provide voting instructions for all accounts referenced to be sure all of your shares are voted.

We hope that you will be able to attend the Special Meeting in person.virtual Annual General Meeting. Whether or not you expect to attend the SpecialAnnual General Meeting, in person, we urge you to vote your shares at your earliest convenience by one of the methods described below, so that your shares will be represented.

|

| | |

| Enstar Group Limited | 2 | 2020 Proxy Statement |

Shareholders of record can vote any one of fourthese ways:

|

| |

| VIA THE INTERNET |

Before the Annual General Meeting: You may vote by proxy via the Internetinternet by following the instructions provided in the Notice.

At the Annual General Meeting: You may vote your shares electronically during the meeting by visiting www.virtualshareholdermeeting.com/ESGR2020. To enter the meeting, holders will need the control number that is printed in the box marked by the arrow on your proxy card. We recommend logging in at least 15 minutes before the meeting to ensure you are logged in when the meeting starts.

|

| BY MAIL | YouIf you received printed copies of the proxy materials, you may vote by proxy by filling out the proxy card and sending it back in the envelope provided.

|

| BY TELEPHONE |

You may vote by proxy by calling the telephone number found on the Internetinternet voting site or on the proxy card.

|

IN PERSON |

You, orcard, if you received a personal representative with an appropriateprinted copy of the proxy may vote by ballot at the Special Meeting. We will give you a ballot when you arrive. If you need directions to the Special Meeting, please call our offices at (441) 292-3645.materials.

|

If you own shares in street name, you will receive instructions from the holder of record that you must follow in order for your shares to be voted. Internet and/or telephone voting also will be offered to shareholders owning shares

|

| | |

Enstar Group Limited | 2 | Special Meeting Proxy Statement |

through most banks and brokers. If you own shares in street name and you wish to attend and/or vote your shares at the Specialvirtual Annual General Meeting, to vote in person, you must (i) obtain a legal proxy from the institution that holds your shares, (ii) obtain your control number so that you may access the webcast and (iii) attend the SpecialAnnual General Meeting, or sendpermit a personal representative with the legal proxy, to vote by ballot.at the virtual Annual General Meeting. You should contact your bank or brokerage account representative to learn how to obtain a legal proxy.

|

| |

12.11. | What is the voting deadline if voting by Internetinternet or telephone? |

If you vote by Internetinternet (before the Annual General Meeting) or by telephone, you must transmit your vote by 11:59 p.m. Eastern time on November , 2019.June 10, 2020.

|

| |

| 12. | Why is the Annual General Meeting being webcast online? |

Due to the impact of the COVID-19 pandemic and to support the health and safety of our shareholders and other participants at the Annual General Meeting, this year’s meeting will be a virtual meeting of shareholders held via a live audio webcast. The virtual meeting will provide shareholders with the same rights as a physical meeting.

|

| |

| 13. | How can I attend and participate in the Specialvirtual Annual General Meeting? |

You may attend the Specialvirtual Annual General Meeting if you were an Enstar shareholder of record as of the close of business on October , 2019April 15, 2020 or you hold a valid proxy for the SpecialAnnual General Meeting. You may attend the meeting by accessing the webcast of the Annual General Meeting, where you will be able to listen to the meeting live, submit questions, and vote online. To do so, you will need to visit www.virtualshareholdermeeting.com/ESGR2020 and use your control number provided in the proxy materials to gain access to the website. If your shares are held in street name, you should be prepared to present photo identification for admittance. follow the directions set forth above in the “How do I vote?” section.If you are a shareholder of record,do not have your namecontrol number, you will not be verified againstable to join the Annual General Meeting, vote at the Annual General Meeting, or ask questions or access the list of shareholders as of the record ondate at the Record Date prior to your being admitted to the SpecialAnnual General Meeting. If you are notattend the virtual Annual General Meeting by participating in the webcast, you will also be able to cast your vote, or revoke a shareholder of record but hold shares through a broker, trustee or nominee,previous vote, during the Annual General Meeting. The meeting webcast will begin promptly at 9:00 a.m. Atlantic time (8:00 a.m. Eastern time). We encourage you to access the meeting prior to the start time. Online check-in will begin at 8:45 a.m. Atlantic time (7:45 a.m. Eastern time), and you should provide proof of beneficial ownership onallow ample time for the Record Date, such as a recent account statement showing your ownership, a copy of the voting instruction card provided by your broker, trustee or nominee, or other similar evidence of ownership.check-in procedures.

|

| |

| 14. | Can I ask questions at the Annual General Meeting? |

Yes, shareholders of record as of the record date will be able to ask questions by joining the virtual Annual General Meeting and typing their question in the box in the Annual General Meeting portal. To help ensure that we have a productive and efficient meeting, and in fairness to all those in attendance, shareholders will also find posted our rules

|

| | |

| Enstar Group Limited | 3 | 2020 Proxy Statement |

of conduct for the Annual General Meeting when logging in prior to the start of the meeting. In accordance with the rules of conduct, we ask that shareholders limit their remarks to one brief question or comment that is relevant to the Annual General Meeting or our business and that such remarks are respectful of fellow shareholders and meeting participants. Questions may be grouped by topic by management with a representative question read aloud and answered. In addition, questions may be deemed to be out of order if they are, among other things, irrelevant to our business, repetitious of statements already made, or in furtherance of the speaker’s own personal, political or business interests. Questions will be addressed in the Q&A portion of the Annual General Meeting.

|

| |

| 15. | What if I need technical assistance accessing or participating in the Annual General Meeting? |

If you encounter any difficulties accessing the Annual General Meeting during the check-in or meeting time, please call the technical support number that will be posted on the Annual General Meeting login page.

|

| |

| 16. | What is the quorum requirement for the SpecialAnnual General Meeting? |

Two or more shareholders present in person or by proxy and entitled to vote at least a majority of the shares entitled to vote at the meeting constitute a quorum for the transaction of business at the meeting. Abstentions and broker non-votes will be included in determining the presence of a quorum at the meeting. A broker non-vote occurs when a beneficial owner of shares held in street name does not provide voting instructions and, as a result, the institution that holds the shares is prohibited from voting those shares on certain proposals. Shares that are properly voted on the Internetinternet or by telephone or for which proxy cards are properly executed and returned, but lacking voting directions, will be counted toward the presence of a quorum. Virtual attendance at the Annual General Meeting also constitutes presence in person for purposes of a quorum.

|

| |

15.17. | How are proxies voted? |

Shares that are properly voted on the Internetinternet or by telephone or for which proxy cards are properly executed and returned will be voted at the SpecialAnnual General Meeting in accordance with the directions given or, in the absence of directions, in accordance with the Board’s recommendations as set forth in "What isare the Board’s voting recommendation?recommendations?" above. If any other business is brought before the meeting, proxies will be voted, to the extent permitted by applicable law, in accordance with the judgment of the persons voting the proxies.

The manner in which your shares may be voted depends on how your shares are held. If you own shares of record, you may vote by proxy, meaning you authorize individuals named on the proxy to vote your shares. If you do not vote by proxy or in person at the SpecialAnnual General Meeting, your shares will not be voted. If you own shares in street name, you may instruct the institution holding your shares on how to vote your shares. If you do not provide voting instructions, the institution may notnevertheless vote your shares on your behalf with respect to the ratification of the appointment of KPMG as the Company’s independent registered public accounting firm for 2020, but not on any other matters being considered at the Special Meeting.meeting.

|

| |

16.18. | What are the voting requirements to approve each of the proposal?proposals? |

|

| | | | |

| Proposal | Voting Requirements | Effect of Abstentions | Effect of Broker Non-Votes |

Approval1. | Election of the amendment and restatement of the Company's 2016 Equity Incentive PlanDirectors | Affirmative Vote of Majority of Votes Cast | No effect on outcome | No effect on outcome |

| 2. | Advisory approval of the Company’s executive compensation | Affirmative Vote of Majority of Votes Cast (to be approved on an advisory basis) | No effect on outcome | No effect on outcome |

| 3. | Ratification of the appointment of KPMG as our independent registered public accounting firm for 2020 and to authorize the Board, acting through the Audit Committee, to approve its fees | Affirmative Vote of Majority of Votes Cast | No effect on outcome | Not applicable |

The proposalEach of the proposals to be voted on at the Special Meetingmeeting is adopted by a majority of votes cast (as indicated in the table above), which means that thea proposal must receive more votes "for" than votes "against" to be adopted. Abstentions and broker non-votes are not considered votes forFor the purposes the proposal, and therefore have no effect on the adoption of the proposal.

|

| | |

| Enstar Group Limited | 34 | Special Meeting2020 Proxy Statement |

director election in Proposal 1, each nominee must receive more votes "for" than votes "against" to have a seat on the Board. Abstentions and broker non-votes are not considered votes for the purposes of any of the above listed proposals, and therefore have no effect on the election of the director nominees or the adoption of any of the other proposals.

|

| |

17.19. | How canCan I change my vote after I have voted? |

You may revoke your proxy and change your vote at any time before the final vote at the SpecialAnnual General Meeting. You may vote again on a later date via the Internetinternet (before the Annual General Meeting) or by telephone (in which case only your latest Internetinternet or telephone proxy submitted prior to 11:59 p.m. Eastern time on November , 2019June 10, 2020 will be counted), by filling out and returning a new proxy card bearing a later date, or by attending the SpecialAnnual General Meeting and voting in person.during the webcast. However, your attendance at the SpecialAnnual General Meeting will not automatically revoke your proxy unless you vote again at the SpecialAnnual General Meeting or specifically request that your prior proxy be revoked by delivering a written notice of revocation prior to the SpecialAnnual General Meeting to our Corporate Secretary at Enstar Group Limited, P.O. Box HM 2267, Windsor Place, 3rd Floor, 22 Queen Street, Hamilton, HM JX Bermuda.

|

| |

18.20. | How are proxies being solicited and who paysWho is paying for the related expenses?cost of this proxy solicitation? |

We will bear the cost of preparing and soliciting proxies, including the reasonable charges and expenses of brokerage firms or other nominees for forwarding proxy materials to the beneficial owners of our ordinary shares. In addition to solicitation by mail, certain of our directors, officers and employees may solicit proxies personally or by telephone or other electronic means without extra compensation, other than reimbursement for actual expenses incurred in connection with the solicitation. In addition, we have retained Innisfree M&A Incorporated, located at 501 Madison Avenue, 20th Floor, New York, NY, 10022, a professional proxy solicitation firm, to provide customary solicitation services for a fee of approximately $22,500 plus out of pocket expenses.

|

| |

19. | To which periods do the compensation-related disclosures contained in this Proxy Statement relate? |

In accordance with the applicable rules of the Securities and Exchange Commission, the director and executive compensation-related disclosures in this Proxy Statement generally relate to our most recently completed fiscal year, which is fiscal year 2018. Where appropriate, in certain instances, we have also included updated information related to the currently ongoing fiscal year 2019. For example, in "Executive Compensation - Compensation Discussion and Analysis", we have included updated information regarding our financial performance during the first six months of 2019, as well as the results of our shareholder vote on compensation at our most recent 2019 annual general meeting. However, this updated information did not influence or impact our compensation-related decisions in respect of fiscal year 2018.

|

| |

20. | Who should I contact if I have questions about this Proxy Statement, the Proposal or voting my shares at the Special Meeting? |

If you have any questions about the proxy materials, Special Meeting or how to vote your shares, please call our proxy solicitor, Innisfree M&A Incorporated, toll-free at (888) 750-5834.

|

| | |

Enstar Group Limited | 4 | Special Meeting Proxy Statement |

THE PROPOSAL

APPROVAL OF THE AMENDED AND RESTATED

ENSTAR GROUP LIMITED 2016 EQUITY INCENTIVE PLAN

On September 19, 2019, our Board adopted, subject to shareholder approval, an amendment and restatement of our 2016 Equity Incentive Plan, which is referred to, as so amended and restated, as the "Amended and Restated Plan", and is referred to, prior to such amendment and restatement, as the "2016 Equity Incentive Plan" or the "Equity Plan". The Amended and Restated Plan includes a new "Joint Share Ownership Plan" or "JSOP" as a sub-plan of the Amended and Restated Plan.

Summary of Proposed Amendments

We established the Equity Plan on June 14, 2016, and it was approved by 99% of votes cast at our 2016 Annual General Meeting. The Equity Plan is intended to provide stock-based awards to our employees, non-employee directors and consultants, but does not currently provide for awards granted through a JSOP. The only changes in the proposed Amended and Restated Plan from the Equity Plan are: (i) those related to the addition of the JSOP structure and sub-plan and (ii) the authorization of an additional 650,000 ordinary shares of the Company (the "Additional Shares") for use under the Amended and Restated Plan. To date, the Equity Plan has allowed us to make equity-based compensation awards to our senior employee population beyond our executive officers, to promote alignment of interests with our shareholders and to motivate, retain and recruit the talented individuals critical to our future growth and profitability. Our Board believes that the addition of the JSOP to the Amended and Restated Plan will enable us to provide long-term equity incentive awards that are tax-efficient for U.K. tax residents, which is a useful tool that would help us retain and incentivize key executives.

As of September 30, 2019, there were 432,293 ordinary shares of the Company ("Shares") available for issuance in connection with awards granted under the Equity Plan, and awards outstanding under the Equity Plan comprised 183,327 PSUs, 94,147 SARs, 78,359 RSUs and 11,430 restricted share awards. The closing sale price of our Shares as of October 15, 2019 was $190.83 per share, as reported on The NASDAQ Global Select Market. The Amended and Restated Plan would increase the maximum number of Shares that are available under the plan by 650,000. If approved, these Additional Shares will be available to make awards to eligible individuals under the Amended and Restated Plan, including through the JSOP.

Under the JSOP, Grantees would acquire jointly held interests in Shares together with the trustee of an employee benefit trust (an "EBT") at fair market value, pursuant to the terms of a joint ownership agreement. A Grantee in the JSOP makes a payment to the Company equal to either the initial value of the Shares underlying the grant or the tax due on the initial fair market value of the Grantee's interest. The Shares underlying any JSOP grant remain in the EBT, and the Grantee receives the value of the appreciation above a threshold on a set number of Shares, measured between date of grant and a pre-set measuring date. Our Compensation Committee (the "Committee"), in granting a JSOP award, can set performance and other conditions, typically related to share price appreciation above a hurdle, that must be met in order for the award to vest. At vesting, the trustee of the EBT will decide, based on the recommendation of the Committee, whether to sell Shares in the market and deliver cash to the Grantee or to deliver the Shares directly to the Grantee. The JSOP structure is designed to allow the Grantee to pay capital gains tax (rather than income tax) on the value received from the award at vesting. The JSOP structure is intended to be a tax-favored means of providing for long-term incentive compensation to Grantees who are U.K. tax residents.

Because a JSOP award delivers value above a threshold but the full number of Shares are held by the EBT, the JSOP can require a significant number of Shares. However, any JSOP we establish would be established on the basis that any Shares not delivered to the Grantee would be available solely for future JSOP awards under the Amended and Restated Plan. If the Company terminates the EBT, any remaining Shares in the EBT would revert to the Company, but such Shares would not be available for issuance in connection with any other awards under the Amended and Restated Plan.

The Committee has undertaken preliminary analysis and consideration of a potential long-term incentive award to our Chief Executive Officer, a U.K. tax resident. Subject to further review, the award would likely be structured as a JSOP award that is subject to time-based and performance-based vesting conditions to be determined, which may include share price appreciation above a hurdle. As of the date of this Proxy Statement, however, we have no definitive agreements or understandings to issue any JSOP awards and any future grants will be subject to the discretion of the Committee. Accordingly, if the Amended and Restated Plan is approved by shareholders, the Additional Shares may be contributed to an EBT in connection with a future JSOP award to our Chief Executive Officer, or they may be used to make other awards (including JSOP awards) to other eligible individuals under the Amended and Restated Plan.

|

| | |

| Enstar Group Limited | 5 | Special Meeting2020 Proxy Statement |

IfCORPORATE GOVERNANCE

Board of Directors

Our Board is divided into three classes designated Class I, Class II and Class III. The term of office for each of our shareholders approveClass II directors expires at this proposal, we expectyear’s Annual General Meeting; the term of office for each of our Class III directors expires at our annual general meeting in 2021; and the term of office for each of our Class I directors expires at our annual general meeting in 2022. At each annual general meeting, the successors of the class of directors whose term expires at that any JSOP awardsmeeting will be structuredelected to hold office for a term expiring at the annual general meeting to be held in the third year following the year of their election.

The Board believes that all of its directors have demonstrated professional integrity, ability and judgment, as issuanceswell as leadership and strategic management abilities, and have each performed well in their respective time served as directors and contributed to non-U.S. persons outsidethe overall effectiveness of the United Statesour Board.

Particular attributes that are exempt from registration pursuantsignificant to Regulation S undereach individual director’s selection to serve on the Securities Act of 1933, as amended (the "Securities Act"). With respect to other equity compensation awards, we intend to file, pursuant to the Securities Act, a registration statement on Form S-8 to register the Additional Shares available for issuance pursuant to the Amended and Restated Plan.Board are described below.

Key Data

The Committee monitors our annual burn rate and total dilution by granting only the number of share-based awards that it believes is necessary to attract, reward and retain our talent. "Burn rate" refers to how quickly a company uses its supply of Shares authorized for issuance under a plan. "Dilution" measures the degree to which our shareholders' ownership has been diluted by the share-based compensation we award under our plan.

The table set forth below shows our burn rate and dilution percentages over the past three years under the Equity Plan. We calculate burn rate by dividing the number of Shares subject to equity awards granted during the fiscal year by the weighted-average number of Shares (basic) outstanding during such fiscal year. We calculate dilution by dividing the number of Shares subject to equity awards outstanding at the end of the fiscal year by the number of Shares outstanding (basic) at the end of the fiscal year. The calculations below do not include Shares related to our Employee Share Purchase Plan or our Amended and Restated Enstar Group Limited Deferred Compensation and Ordinary Share Plan for Non-Employee Directors.

|

| | | | |

| | 2018 | 2017 | 2016 | 3-Year Average |

| Burn Rate | 0.21% | 0.95% | 0.23% | 0.46% |

| Dilution | 1.02% | 1.16% | 0.41% | 0.86% |

Summary of the Key Terms of the Amended and Restated Plan

This section summarizes the material terms of the Amended and Restated Plan. The full text of the Amended and Restated Plan is set forth in Appendix A to this Proxy Statement. Certain features of the Amended and Restated Plan are summarized below, but the summary is qualified in its entirety by reference to the full text of the Amended and Restated Plan. All capitalized terms not defined in this proposal have the meanings set forth in the Amended and Restated Plan.

Amended and Restated Plan SnapshotNominees

|

| |

| B. FREDERICK (RICK) BECKER |

What the AmendedDirector Since: 2015 Age: 73 Class: II Enstar Committees: Audit, Compensation (Chair), Nominating and Restated Plan DOES | What the Amended and Restated Plan DOES NOT DO |

þ | Performance-based awards vest on a pro rata basis upon a Change in Control | ý | Governance (Chair) No liberal Change in Control definitionUS resident; US citizen

|

þ | Requires 12-month minimum vesting periodBiographical Information: Rick Becker has 40 years of experience in the insurance and healthcare industries. He currently serves as Chairman of Dorada Holdings Ltd. (Bermuda), and he served as Chairman of Clarity Group, Inc., a company he co-founded more than 18 years ago that specialized as a healthcare professional liability and risk management service provider until it was sold in early 2020. Prior to co-founding Clarity Group, Inc., he served as Chairman and Chief Executive Officer of MMI Companies, Inc. from 1985 until its sale to The St. Paul Companies in 2000. Mr. Becker has previously served as President and CEO of Ideal Mutual and McDonough Caperton Employee Benefits, Inc., and also served as State Compensation Commissioner for options/SARs (with 5% carve out pool) | ý | No evergreen renewal provision

|

þ | Applies annual award limits for employees and directors | ý | No grantingthe State of reload options

|

þ | Awards under plan are subject to our Clawback Policy | ý | No excise tax gross-up provisionWest Virginia.

|

þ

| Shareholder approval is required to issue additional shares | ý | NoCertain Other Directorships: single-trigger accelerationMr. Becker currently serves as Chairman of awards uponDorada Holdings Ltd. (Bermuda) and as a Change in Control if acquirer assumes the award or substitutes a new awarddirector of West Virginia Mutual Insurance Company, both of which are privately held.

|

þ | All stock optionsSkills and SARs must haveQualifications:Compensation, governance, and risk management experience; industry knowledge Mr. Becker has over 35 years of experience within the insurance and healthcare industries. The Board also values Mr. Becker’s corporate governance experience, which he has gained from serving on many other boards over the years. In addition, his previous work on compensation matters makes him well-suited to serve as Chairman of our Compensation Committee. He has an exercise price or base price equal to or greater than the fair market value of the underlying Shares on the grant date | ý | No repricing or cash buy-out of underwater optionsextensive background in risk management, which enhances our risk oversight and SARs without shareholder approvalmonitoring capabilities.

|

Eligibility for Participation

All employees, non-employee directors and consultants are legally eligible to participate in the Equity Plan. As of October 14, 2019, total eligible participants included eight executive officers, the Company's nine non-employee directors and approximately 1,500 others. Such employees, non-employee directors and consultants will continue to be eligible to receive an award under the Amended and Restated Plan if he or she is selected to receive an award by the Committee. An individual who receives an award under the Amended and Restated Plan is referred to in this proposal as a "Grantee". Although eligible under the Amended and Restated Plan, the Committee does not currently have any intention of granting JSOP awards to non-employee directors or consultants.

|

| | |

| Enstar Group Limited | 6 | Special Meeting2020 Proxy Statement |

Administration of the Amended and Restated PlanThe Committee would administer the Amended and Restated Plan, select the employees, non-employee directors and consultants who are eligible to participate, and determine the timing and amounts of any awards and the specific provisions of award agreements. |

| |

| JAMES D. CAREY |

Director Since: 2013 Age: 53 Class: II Enstar Committee: Investment US resident; US citizen |

Biographical Information: James Carey is a senior principal of Stone Point Capital LLC, a private equity firm based in Greenwich, Connecticut. Stone Point Capital serves as the manager of the Trident Funds, which invest exclusively in the global financial services industry. Mr. Carey has been with Stone Point Capital and its predecessor entities since 1997. He previously served as a director of the Company from its formation in 2001 until the Company became publicly traded in 2007. Mr. Carey rejoined the Board in 2013. |

Certain Other Directorships: From July 2018, Mr. Carey has served as a director of Focus Financial Partners, a publicly traded compay that invests in independent fiduciary wealth management firms. Mr. Carey also currently serves on the boards of certain privately held portfolio companies of the Trident Funds. He previously served as non-executive chairman of PARIS RE Holdings Limited and as a director of Alterra Capital Holdings Limited, Cunningham Lindsay Group Limited, Lockton International Holdings Limited,and Privilege Underwriters, Inc. Mr. Carey also serves as a director of StarStone Specialty Holdings Ltd. and the holding companies that we and Trident established in connection with the Atrium/Arden and StarStone co-investment transactions. |

Skills and Qualifications: Investment expertise; industry knowledge; significant acquisition experience Having worked in the private equity business forover 20 years, Mr. Carey brings an extensive background and expertise in the insurance and financial services industries. His in-depth knowledge of investments and investment strategies is significant in his role on our Investment Committee. We also value his contributions as an experienced director in the insurance industry, as well as his extensive knowledge of the Company. |

Available Shares under the Amended and Restated Plan

Of the Shares authorized for issuance in connection with awards made under the Equity Plan, there were 432,293 Shares available as of September 30, 2019. In addition, the Equity Plan also authorizes any Shares that are subject to an award under our 2006 Equity Incentive Plan (“the 2006 Equity Plan”) that expires or is canceled, terminated, forfeited or settled in cash which underlying Shares would have become available for future award under the 2006 Equity Plan. The maximum aggregate number of Shares that may be issued under the Amended and Restated Plan is equal to the (i) number of Shares that remain available for use in connection with Awards under the Equity Plan immediately prior to the date on which the amendment and restatement is approved by our shareholders, (ii) any Shares that are subject to an award under the 2016 Equity Incentive Plan as of the date on which the amendment and restatement is approved by our shareholders that expires or is canceled, terminated, forfeited or settled in cash and would have become available for future award under the 2016 Equity Incentive Plan (including Shares that would have become available for future award under the 2006 Equity Plan as described above) and (iii) the Additional Shares. Shares issuable under the Amended and Restated Plan consist of authorized but unissued Shares and/or previously issued Shares that the Company reacquires.In general, if any outstanding awards granted under the Amended and Restated Plan expire, terminate, are forfeited or are settled in cash, the Shares reserved for those awards will be available for subsequent awards. However, the following Shares will not again become available for issuance under the Amended and Restated Plan: (i) awarded Shares that are withheld by the Company to satisfy any tax withholding obligation or any previously acquired Shares tendered in payment of taxes relating to an award; (ii) Shares that would have been issued upon exercise of an option but for the fact that the exercise was pursuant to a "net-exercise" arrangement; (iii) Shares covered by a stock appreciation right that are not issued in connection with the stock settlement of the stock appreciation right upon its exercise; and (iv) Shares that are repurchased by the Company using option exercise proceeds. In addition, with respect to JSOP awards, the EBT would retain any Shares not used to settle the JSOP award solely for use in future JSOP awards under the Amended and Restated Plan. When the EBT is no longer needed for future JSOP awards, the Company intends to terminate the EBT and have its remaining Shares returned to the Company, but such Shares would not be available for issuance in connection with any other awards under the Amended and Restated Plan. |

| |

| WILLARD MYRON HENDRY, JR. |

Director Since: 2019 Age: 71 Class: II Enstar Committee: Nominating & Governance, Risk US resident; US citizen |

Biographical Information: Myron Hendry most recently served as an executive advisor to AXA on integration matters. He previously served as the Executive Vice President and Chief Platform Officer for XL Catlin from 2009-2018, where he was responsible, on a Global basis, for Technology, Operations, Real Estate, Procurement, Continuous Improvement Programs and XL Catlin’s Service Centers in India and Poland. He also served as Director on the XL India Business Services Private Limited Board, and he was the Chairman of the XL Catlin Corporate Crisis Committee responsible for Disaster Recovery and Business Continuity. Mr. Hendry was the founder of the XL Catlin’s Leadership Listening Program. Throughout his career, he also held technology, operational and claims leadership roles at Bank of America’s Balboa Insurance Group, Safeco Insurance and CNA Insurance. |

Skills and Qualifications: Operations and Technology Mr. Hendry brings to our Board expertise in insurance industry-specific information technology and operations management. His extensive experience as an executive engaging on technology matters at the board level is valuable to our Board and Risk Committee. |

Stock Options

A stock option entitles a Grantee, on the exercise thereof, to purchase Shares at a specified price for a specified period of time. Stock options, including incentive stock options (available to employees only) and non-qualified stock options (available to employees, directors and consultants), may be granted under the Amended and Restated Plan under terms and conditions established by the Committee.

Options must have an exercise price of not less than the fair market value of a Share on the date of grant. The fair market value generally is the quoted closing price of a Share, as reported by the NASDAQ Global Select Market, on the relevant date. The exercise price of an option may be paid in cash, or to the extent permitted by an award agreement, through delivery of previously held Shares, newly acquired Shares, a cashless exercise or any combination thereof.

Options, including ISOs, for more than 120,000 Shares may not be granted in any calendar year to any one Grantee. If an option is canceled, the Shares covered by the canceled option will be counted against the maximum number of Shares that may be subject to options granted to a single Grantee in any calendar year.

Except as otherwise provided under an award agreement, options will become exercisable in three equal annual installments. This means that an option will generally become exercisable with respect to one-third of the covered Shares on the first anniversary of the grant date, and with respect to an additional one-third on each of the next two anniversaries of the grant date. In addition, except as otherwise provided under the Amended and Restated Plan or an award agreement, options will not become exercisable earlier than one year after the date of grant, provided that the aggregate amount of options and stock appreciation rights up to a maximum of 5% of the Shares available for awards under the Amended and Restated Plan may be granted without regard to the minimum one-year exercise requirement. The Committee may establish performance-based criteria for exercisability of any option.

Stock Appreciation Rights

A stock appreciation right ("SAR") is an award entitling a Grantee, on exercise, to receive an amount in cash,

|

| | |

| Enstar Group Limited | 7 | Special Meeting2020 Proxy Statement |

Shares or a combination thereof (as determined by the Committee), equal to the excess of the Share’s fair market value on the date of exercise over its fair market value on the date of grant.SARs may be granted under terms and conditions determined by the Committee, provided that the aggregate number of Shares subject to stock-settled SARs granted to any one Grantee in a calendar year shall not exceed 120,000 Shares. In addition, the aggregate number of cash-settled SARs granted to any one Grantee under the Amended and Restated Plan in a calendar year shall not exceed 300,000. If a SAR is canceled, the Shares covered by the canceled SAR shall be counted against the maximum number of Shares that may be subject to SARs granted to a single Grantee in any calendar year. |

| |

| HITESH PATEL |

Director Since: 2015 Age: 59 Class: II Enstar Committees: Audit, Nominating and Governance, Risk (Chair) UK resident; UK citizen |

Biographical Information: Hitesh Patel served as Chief Executive Officer of Lucida, plc, a UK life insurance company, from 2012 to 2013, and prior to that as its Finance Director and Chief Investment Officer since 2007. Mr. Patel has over 30 years of experience working in the insurance industry, having served in the United Kingdom as KPMG LLP's Lead Partner on Insurance Accounting and Regulatory Services from 2000 to 2007. He originally joined KPMG in 1982 and trained as an auditor. |

Certain Other Directorships:Mr. Patel is the Independent Non-Executive Chairman of Capital Home Loans Limited, a privately held buy-to-let mortgage provider and also a non-executive director of Landmark Mortgages Limited. Mr. Patel chairs the Audit Committee and is a member of the Risk Committee and Nomination and Remuneration Committee for Capital Home Loans and Landmark Mortgages Limited. Mr. Patel has recently been appointed to the council of the London School of Hygiene and Tropical Medicine. He is also the Chair of the Insurance Committee of the Institute of Chartered Accountants of England and Wales since 2012. Until December 2019, Mr. Patel served as a non-executive director at Aviva Life Holdings UK Ltd and Aviva Insurance Limited (subsidiaries of Aviva plc) and as Chairman of its Audit Committee and member of the Risk and Investment Committees. |

Skills and Qualifications: Accounting expertise; regulatory and governance skills; industry experience Mr. Patel brings significant accounting expertise to our Board, obtained from over two decades of auditing and advising insurance companies on accounting and regulatory issues, which is highly valuable to our Audit Committee. His experience with insurance regulations and the regulatory environment is also a key attribute because our company is regulated in many jurisdictions around the world. As a former industry CEO, he also has significant knowledge of corporate governance matters and practices, which is valuable to our Board and the Nominating and Governance Committee. |

SARs may be granted in connection with an option or may be granted independently. SARs that are granted in connection with an option may only be exercised upon the surrender of the right to exercise the option for an equivalent number of Shares.

Except as otherwise provided under an award agreement, SARs will become exercisable in three equal annual installments. This means that a SAR will generally become exercisable with respect to one-third of the covered Shares on the first anniversary of the grant date, and with respect to an additional one-third on each of the next two anniversaries of the grant date. In addition, except as otherwise provided under the Amended and Restated Plan or an award agreement, SARs will not become exercisable earlier than one-year after the date of grant, provided that the aggregate amount of options and SARs up to a maximum of 5% of the Shares available for awards under the Amended and Restated Plan may be granted without regard to the minimum one-year exercise requirement. The Committee may establish performance-based criteria for exercisability of any SAR.

Restricted Stock Awards

A restricted stock award is an award of Shares that is subject to restrictions and conditions established by the Committee. The Committee may condition the vesting of such Shares on continued service through a stated period of time ("Restricted Stock") or the attainment of certain performance goals during a stated performance period ("Performance Stock"). The performance period selected by the Committee will be no less than one year and no more than five years. Restricted Stock will become fully vested if a Grantee’s service terminates due to disability (as defined in the Amended and Restated Plan) or death.

Restricted Stock awards may be granted under terms and conditions determined by the Committee, provided that the maximum aggregate number of Shares subject to Performance Stock and performance stock units ("PSUs"), in the aggregate, that can be granted to a single Grantee in any calendar year is 120,000. If a PSU is settled for cash, the Shares covered by the cash-settled PSU will be counted against the maximum number of Shares that may be subject to PSUs and Performance Stock granted to one Grantee in any calendar year.

Restricted Stock Unit/Performance Stock Unit Awards

Each vested stock unit award allows a Grantee to receive either one Share, cash equal to the fair market value of such Share, or a combination thereof, as decided by the Committee. The Committee may condition the vesting of stock unit awards on continued service through a stated period of time ("RSUs") or the attainment of certain performance goals during a stated performance period. The performance period selected by the Committee will be no less than one year and no more than five years. RSUs become fully vested if a Grantee terminates service due to disability (as defined in the Amended and Restated Plan) or death. Shares or cash, as applicable, will be delivered upon vesting unless a Grantee’s award agreement provides for a later delivery date.

Stock unit awards may be granted under terms and conditions determined by the Committee, provided that the maximum number of Shares subject to PSUs and Performance Stock, in the aggregate, that can be granted to a single Grantee in any calendar year is 120,000 Shares. If a PSU is settled for cash, the Shares covered by the cash-settled PSU shall be counted against the maximum number of Shares that may be subject to PSUs and Performance Stock granted to a Grantee in any calendar year.

The Committee may grant dividend equivalent rights in connection with RSUs and PSUs. Generally, the terms and conditions (e.g., the payment date, vesting schedule and impact of any termination of service) of such dividend equivalent rights will be substantially identical to the terms and conditions of the associated RSUs and PSUs.

Bonus Share Awards

A bonus share award ("Bonus Share") is an award of Shares by the Committee for any reason. The Committee may award Shares under the Amended and Restated Plan as full or partial payment of an award under the Enstar Group Limited Annual Incentive Compensation Program ("Incentive Compensation Program") or may award Bonus Shares that are unrelated to the Incentive Compensation Program. The maximum aggregate number of Bonus Shares

|

| | |

| Enstar Group Limited | 8 | Special Meeting2020 Proxy Statement |

that may be granted under the Amended and Restated Plan to any one Grantee is 120,000.Continuing Directors

Dividend Equivalent RightsA dividend equivalent right is the right to receive an amount equal to the cash dividend paid by the Company on one Share. The Committee may grant dividend equivalent rights with respect to an RSU or PSU or may grant dividend equivalent rights as a separate award unrelated to any other award under the Amended and Restated Plan. |

| |

| ROBERT CAMPBELL |

Director Since: 2007 Age: 71 Class: I Enstar Committees: Audit (Chair), Compensation, Investment (Chair), Nominating and Governance, Executive US resident; US citizen |

Biographical Information: Robert Campbell was appointed as the independent Chairman of the Board in November 2011. Mr. Campbell has been a Partner with the investment advisory firm of Beck, Mack & Oliver, LLC since 1990. |

Certain Other Directorships: Mr. Campbell is a director and chairman of the audit committee of AgroFresh Solutions, Inc. (formerly Boulevard Acquisition Corp.), a publicly traded global agricultural technologies company. From 2015 through 2017, he was also a director of Boulevard Acquisition Corp. II, a blank check company that completed its initial public offering in September 2015. He previously served as a director of Camden National Corporation, a publicly traded company, from 1999 to 2014. |

Skills and Qualifications: Financial, accounting, and investment expertise; leadership skills Mr. Campbell brings to the Board his extensive understanding of finance and accounting, which he obtained through over 40 years of analyzing financial services companies and which is very valuable in his role as chairman of our Audit Committee. In addition, Mr. Campbell’s investment management expertise makes him a key member of our Investment Committee, of which he serves as chairman. Mr. Campbell continues to spend considerable time and energy in his role, which is significant to the leadership and function of our Board. |